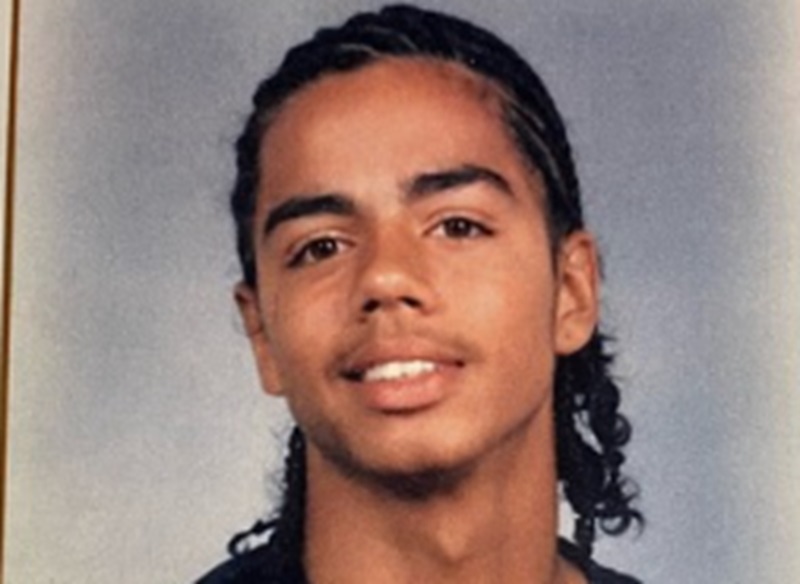

SUMMERVILLE, S.C.–United States Attorney Bill Nettles stated Tuesday that Scott M. Wickersham, age 36, of Summerville, has been sentenced in federal court in Charleston, South Carolina for Conspiracy to Commit Mail Fraud, Wire Fraud, and Bank Fraud, a violation of 18 U.S.C. § 1349, and two counts of Willfully Making and Subscribing a False Tax Return, in violation of Title 26, United States Code, Section 7206(1).

U.S. District Judge Richard M. Gergel sentenced Wickersham to 36 months in federal prison for the conspiracy count and 30 months on each of the two tax fraud counts, to run concurrently.

Judge Gergel also ordered Wickersham to serve five years of supervised release on the conspiracy count and one year of supervised release on each of the two tax fraud counts after he is released from prison, to run concurrently.

Wickersham was also ordered to pay restitution in the amount of $23,997,151 on the conspiracy count, and he was further ordered to pay the Internal Revenue Service a total of $256,862 in restitution for the two tax counts.

Evidence presented in court documents and hearings established that Wickersham participated in a mortgage fraud conspiracy that utilized real estate and mortgage businesses operated in Summerville, South Carolina, under the names North American Mortgage Group, LLC; Realty Executives of Coastal Carolina; and New Freedom Enterprises, LLC.

The scheme involved more than 70 properties, approximately $45 million of mortgage loans, and a loss of more than $23 million suffered by financial institutions. The properties were located in Charleston, Johns Island, Ladson, Mount Pleasant, Summerville, Edisto Island, St. Helena Island, Garden City, Murrells Inlet, Myrtle Beach, North Myrtle Beach, Lake Keowee, and Tybee Island, Georgia.

Wickersham was a loan officer for North American Mortgage Group, LLC; a real estate agent and part-owner/franchisee of Realty Executives of Coastal Carolina; and a partner in New Freedom Enterprises, LLC. Wickersham and others used straw purchasers and made other false representations on mortgage loan applications to induce financial institutions to provide mortgage loans for the properties in the scheme. The properties later went into foreclosure and sold at a significant loss to the lenders.

In addition to his participation in the mortgage fraud scheme, Wickersham also willfully made and filed false U.S. Individual Income Tax Returns, Forms 1040, for calendar years 2006 and 2007. Both of those returns, which he filed late on January 27, 2009, were materially false because he willfully failed to report income he received from the mortgage fraud scheme.

Specifically, on line 22 of the 2006 tax return, he claimed $103,205 of total income when he knew he had at least $965,402 of total income. On line 22 of the 2007 tax return, he claimed $13,383 of total income when he knew he had at least $256,119 of total income. This under reporting resulted in a tax loss of $206,100 for 2006 and $50,762 for 2007, for a total tax loss of $256,862. Each return was verified by a written declaration that it was made under the penalties of perjury.

Two other defendants have been convicted in connection with the mortgage fraud scheme. Steven F. Weiss, 67, of Virginia Beach, Virginia, pleaded guilty to one count of Conspiracy to Commit Mail Fraud, Wire Fraud, and Bank Fraud, in violation of Title 18, United States Code, Section 371. Weiss, a former loan officer of North American Mortgage Group, LLC, was sentenced in April to 30 months in federal prison.

Judge Gergel also ordered Weiss to serve three years of supervised release after he is released from prison and to pay restitution in the amount of $4,961,732. Kelly Martin, 34, of Moncks Corner, pleaded guilty in 2015 to one count of Conspiracy to Commit Mail Fraud, Wire Fraud, and Bank Fraud, in violation of Title 18, United States Code, Section 371. She is awaiting sentencing.

The case was investigated by agents of the Federal Bureau of Investigation (FBI) and the Internal Revenue Service-Criminal Investigation (IRS-CI). Assistant United States Attorney Dean H. Secor of the Charleston office prosecuted the case.

Recent Comments