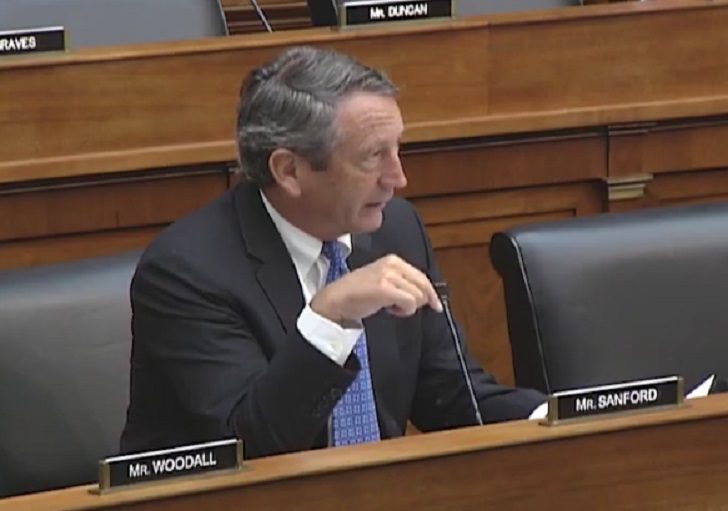

I voted yesterday for the Tax Cuts and Jobs Act of 2017 because I believe the whole of the bill represents more good than bad for our country and the people of coastal South Carolina. Some components – like opening up the Arctic Refuge, temporary tax changes for individuals versus permanent for corporations, a lack of simplification, and more – I did not like. But again, I had to vote on the bill in its entirety.

With it came many perceptions and misperceptions, and I’d like to explain three things that in the final analysis got me to a yes.

Revenues not Rates

In tax policy, you may cut rates but still have revenue go up. People tend to conflate the two, believing a cut in rate ultimately leads to a cut in revenue. Politicians talk about “cutting taxes,” but when you actually look at the money coming into government’s coffers, revenue (government’s take from its citizenry) continues to climb.

Without the tax bill, revenue coming into the federal government will rise from about $3.3 trillion annually to about $5 trillion over the next 10 years, which is about a 50% increase. With the tax bill, it’ll rise to about the same number but get there more slowly – which amounts to the tax cut component of the bill.

Over the next decade, the federal government is projected to take in $43 trillion from American citizens. With the tax cut, that number drops to $41.5 trillion. The question we all have to ask ourselves is whether or not you think our federal functions can work at $41.5 trillion instead of $43 trillion. That’s a 3.5% difference, and both political parties have exaggerated the effect of this change.

This bill keeps us about where we’ve been on revenue to the federal government as a percentage of the overall economy. The numbers show how vital spending restraint will be. Historically, the federal government has brought in about 18% of GDP in taxes. This has been remarkably consistent – regardless of tax rates. However, spending has risen steadily to about 20.7% today. It takes no mathematician to recognize that if you take in 18 but spend 20, you have a problem. This tax bill will leave us within less than half of 1% of our historic norm on revenue. Meanwhile, spending is projected to rise to 23.4% over the same ten years…about 3.5% above average.

We’re Toast Without Change

If we do nothing, our debt-to-GDP numbers are projected to continue to rise dramatically over the next decade from 77% today to 91%. It was 35% as recently as 2007. With this tax bill, it would rise another 5% to 96%.

In short, we are in real trouble either way, if we have not done something material to cut spending and to increase economic growth. The bet on this bill is that it will help with the latter. It is not a guarantee, but an educated bet in attempting to lift us beyond the 1.8% growth projected over the next 10 years.

Most Systems Can Occasionally Use An Upgrade

The bill has been described as comprehensive reform, but it’s primarily aimed at bettering the business and corporate tax environments. One can argue for or against the change in distribution of tax benefits, but from the standpoint of raw competitiveness of the American society, this bill moves us toward being more competitive globally.

Over the last decade, industrialized countries have lowered their rates to the point that America’s marginal corporate tax rate is the highest worldwide. The industrialized average on corporate tax rates is now 23%, and this bill moves us from 35% to 20%. Lowering corporate rates is in fact a bipartisan idea. Senator Ron Wyden (D-OR) has proposed doing this for the last seven years, and President Obama even suggested dropping the corporate rate to 28% as recently as last year.

The bill would also move us from a global corporate tax system to a territorial one, which aligns with the way that most other countries tax corporate earnings. Not addressing these two issues has driven companies like Johnson Controls, Burger King, and many other long-time American companies to move their corporate headquarters overseas.

There are a host of other pros and cons in the bill that I describe in a longer 4,500 word piece I posted on my Facebook page, but it’s these economic realities that drove my vote yesterday. I believe I was elected to limit the size and scope of government as tools to advancing both liberty and our economy – and limiting both taxes and spending are close proxies in efforts to do so. This bill represented half that equation; it will be vital Congress gets the other half right as well.