The arrests are part of the SC Department of Revenue’s efforts to crack down on tax preparers who illegally benefit by filing fraudulent tax returns on behalf of clients but without their knowledge or consent.

“While there are many excellent and reputable tax preparers, unfortunately there are some who unlawfully take advantage of unsuspecting clients,” said Rick Reames, Director of the SC Department of Revenue. “We urge South Carolinians to use great care and caution when selecting tax preparation assistance.”

Today’s arrests are outlined below and carry the following criminal penalties upon conviction:

- Assisting in the Preparation of a Fraudulent or False Return – up to five years imprisonment and/or up to a $500 fine per count

- Forgery – up to five years imprisonment and/or up to a $10,000 fine per count

- Income Tax Evasion – up to five years imprisonment and/or up to a $10,000 fine per count

Darryl Wallace, Barnwell County

Darryl Wallace of Williston, SC, is charged with 10 counts of Assisting in the Preparation of a Fraudulent or False Return and one count of Forgery. During 2012 and 2013 Wallace, without consent or knowledge of his clients, knowingly inflated wage and withholding amounts on W-2s and created fraudulent itemized deductions to generate increased tax refunds for his clients. Wallace also included a fraudulent W-2 with his 2012 individual state income tax return in order to receive a higher refund. The tax due as determined by civil audit collectively amounts to $22,828.

Wallace is currently being held at the Barnwell County Detention Center awaiting a bond hearing.

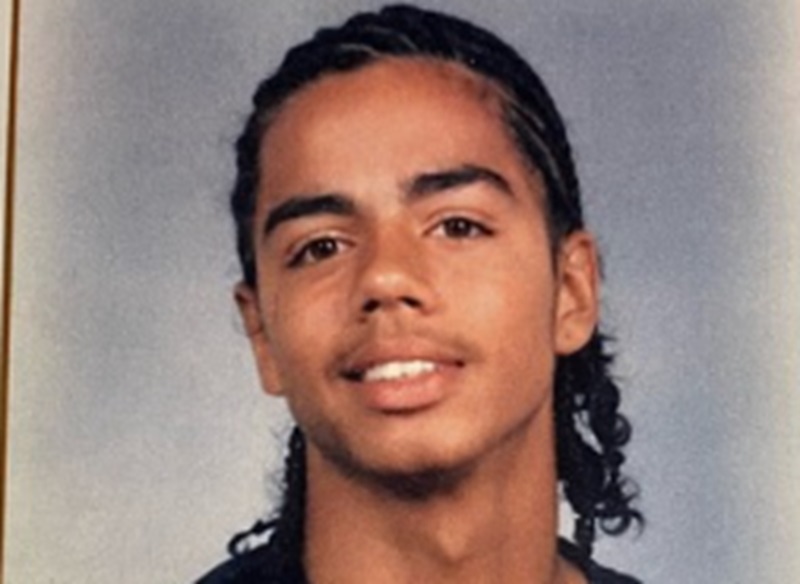

Nathan Norman Widener, Horry County

Nathan Norman Widener of North Myrtle Beach, SC, was arrested on three counts of Income Tax Evasion and 13 counts of Assisting in the Preparation of a Fraudulent or False Return. For tax years 2010, 2011 and 2012, Widener evaded the assessment of income taxes by filing fraudulent South Carolina individual income tax returns. The total tax evaded and owed to the state is $11,433.

For tax years 2010, 2011 and 2012, Widener also prepared and electronically submitted 13 fraudulent individual state income tax returns for clients, reporting losses from businesses that did not exist and claiming unentitled deductions, all without client knowledge or consent. As a result of filing fraudulent income tax returns, Widener’s clients owe the state a total of $60,389.

Widener is currently being held at the J. Rueben Long Detention Center in Horry County awaiting a bond hearing.

Mark Eric Widener and Sharon Rogers Widener, Horry County

Mark Eric Widener and wife Sharon Rogers Widener, both of Little River, SC, were each charged with four counts of Income Tax Evasion. For tax years 2009 through 2012, the Wideners evaded the assessment of income taxes by creating fake businesses with expenses. The Wideners claimed a total of $10,084 in income subject to state tax on their South Carolina married filing jointly tax returns from 2009 through 2012, yet the actual income subject to tax for these years was $488,718. Mark Widener also evaded the assessment of state tax by filing multiple fraudulent W-4 withholding allowance forms with his employer. The total tax evaded and owed to South Carolina by Mark and Sharon Widener is $31,321.

- ‘Light The Way For Hope’ Ceremony To Remember Those Lost To Overdose - August 22, 2024

- Berkeley County Opening Emergency Shelters Ahead of Debby - August 5, 2024

- Nearly Century-Old St. Stephen School To Be Torn Down - March 20, 2024

Recent Comments